Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

What’s Motivating Your Move?

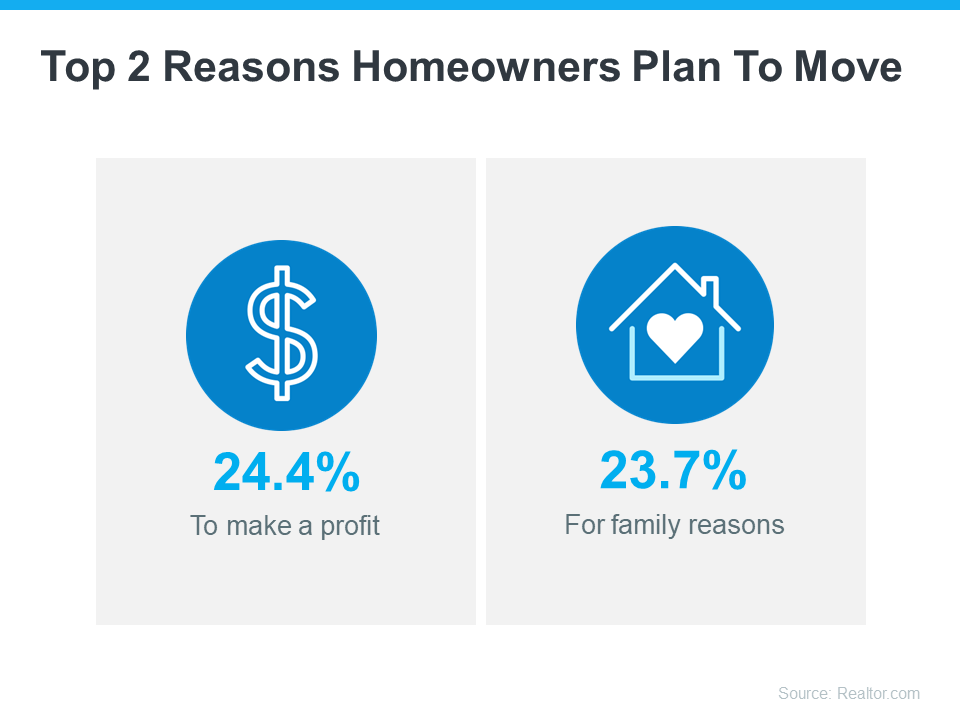

Thinking about selling your house? As you make your decision, consider what’s pushing you to think about moving. A recent survey from Realtor.com looked into why people want to sell their homes this year. Here are the top two reasons (see graphic below):

Thinking about selling your house? As you make your decision, consider what’s pushing you to think about moving. A recent survey from Realtor.com looked into why people want to sell their homes this year. Here are the top two reasons (see graphic below):

Let’s take a closer look and see if they’re motivating you to make a change too.

1. To Make a Profit

If you’re thinking about selling your house, you probably have a lot of questions on your mind. Well, here’s some good news – the latest data shows most sellers get a great return on their investment when they sell. ATTOM, a property data provider, explains:

“. . . home sellers made a $121,000 profit on the typical sale in 2023, generating a 56.5 percent return on investment.”

That’s significant. And here’s one contributing factor. During the pandemic, home prices skyrocketed. There was way more buyer demand than homes available for sale and that combination pushed prices up.

Now, home prices are still rising, just not as fast. That ongoing appreciation is good news for your bottom line. Any profit you make can help offset some of today’s affordability challenges when you buy your next home.

If you want to know how much your house is worth now and what’s going on with prices in your area, talk to a local real estate agent.

2. For Family Reasons

Maybe you want to be near relatives to help take care of older family members or to have more support nearby. Or maybe you’re just eager to spend time together on special occasions like birthdays and holidays.

Selling a house and moving closer to the people who matter the most to you helps keep you connected. If the distance is making you miss out on some big milestones in their lives, it might be time to talk to a local real estate agent to find a place close by. The National Association of Realtors (NAR) says:

“A great real estate agent will guide you through the home search with an unbiased eye, helping you meet your buying objectives while staying within your budget.”

Bottom Line

If you’re thinking about selling your house, there’s probably a good reason for it. Let’s talk so you have help making the right move to reach your goals this year.

Now’s a Great Time To Sell Your House

Thinking about selling your house? If you are, you might be weighing factors like today’s mortgage rates and your own changing needs to figure out your next move.

Thinking about selling your house? If you are, you might be weighing factors like today’s mortgage rates and your own changing needs to figure out your next move.

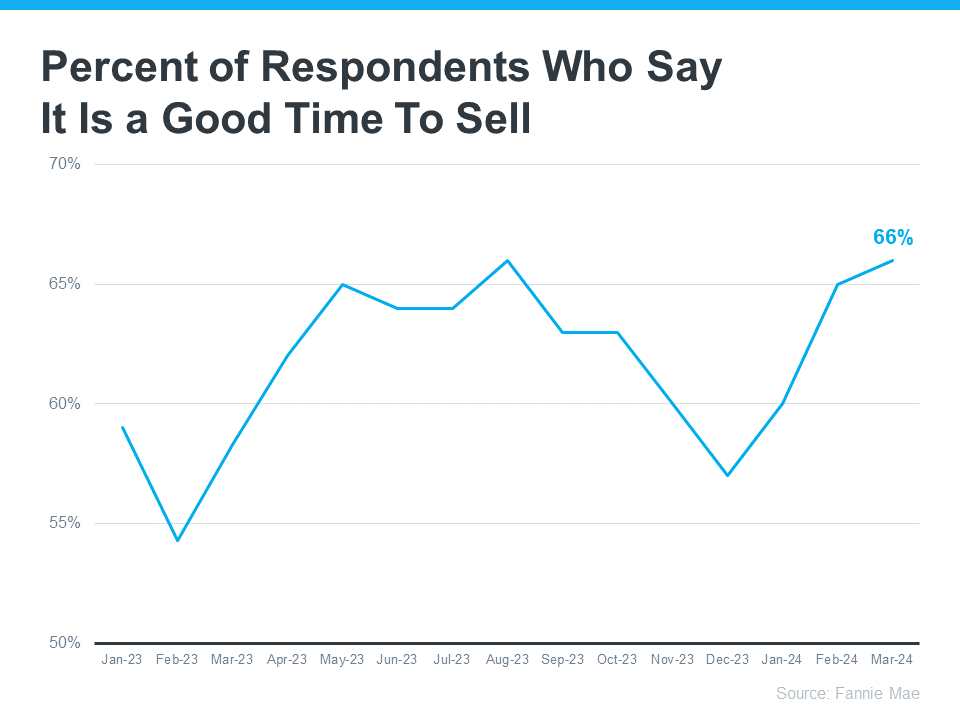

Here’s something else to consider. According to the latest Home Purchase Sentiment Index (HPSI) from Fannie Mae, the percent of respondents who say it’s a good time to sell is on the rise (see graph below):

Why Are Sellers Feeling so Optimistic?

One reason why is because right now is traditionally the best time of year to sell a house. A recent article from Bankrate says:

“Late spring and early summer are generally considered the best times to sell a house. . . . While today’s rates are relatively high, low inventory is still keeping sellers in the driver’s seat in most markets.”

These are the seasons when most people move. That means buyer demand grows. And because there still aren’t enough homes for sale to meet that demand, sellers see some serious perks. According to Rocket Mortgage:

“Homes that are listed at the end of spring and the beginning of summer typically sell faster at a higher sales price.”

What Does This Mean for You?

More sellers are coming to realize conditions are ripe for a move. And that’s one reason why we’re seeing more homeowners put their homes up for sale. If you think you might want to get in on the action, it’s a good idea to start preparing.

A local real estate agent can help you get your house ready by offering advice on how best to fix it up and make it appealing to buyers in your area.

They also know if you list during the peak buying seasons of spring and early summer, you might sell quickly and for a higher price.

Bottom Line

If you list during the spring and early summer, you might sell your house quickly and for a higher price. When you’re ready to make the most of today’s seller’s market, let’s get in touch.

Is It Getting More Affordable To Buy a Home?

Over the past year or so, a lot of people have been talking about how tough it is to buy a home. And while there’s no arguing affordability is still tight, there are signs it’s starting to get a bit better and may improve even more throughout the year. Elijah de la Campa, Senior Economist at Redfin, says:

Over the past year or so, a lot of people have been talking about how tough it is to buy a home. And while there’s no arguing affordability is still tight, there are signs it’s starting to get a bit better and may improve even more throughout the year. Elijah de la Campa, Senior Economist at Redfin, says:

“We’re slowly climbing our way out of an affordability hole, but we have a long way to go. Rates have come down from their peak and are expected to fall again by the end of the year, which should make homebuying a little more affordable and incentivize buyers to come off the sidelines.”

Here’s a look at the latest data for the three biggest factors that affect home affordability: mortgage rates, home prices, and wages.

1. Mortgage Rates

Mortgage rates have been volatile this year – bouncing around in the upper 6% to low 7% range. That’s still quite a bit higher than where they were a couple of years ago. But there is a sliver of good news.

Despite the recent volatility, rates are still lower than they were last fall when they reached nearly 8%. On top of that, most experts still think they’ll come down some over the course of the year. A recent article from Bright MLS explains:

“Expect rates to come down in the second half of 2024 but remain above 6% this year. Even a modest drop in rates will bring both more buyers and more sellers into the market.”

Any drop in rates can make a difference for you. When rates go down, you can afford the home you really want more easily because your monthly payment would be lower.

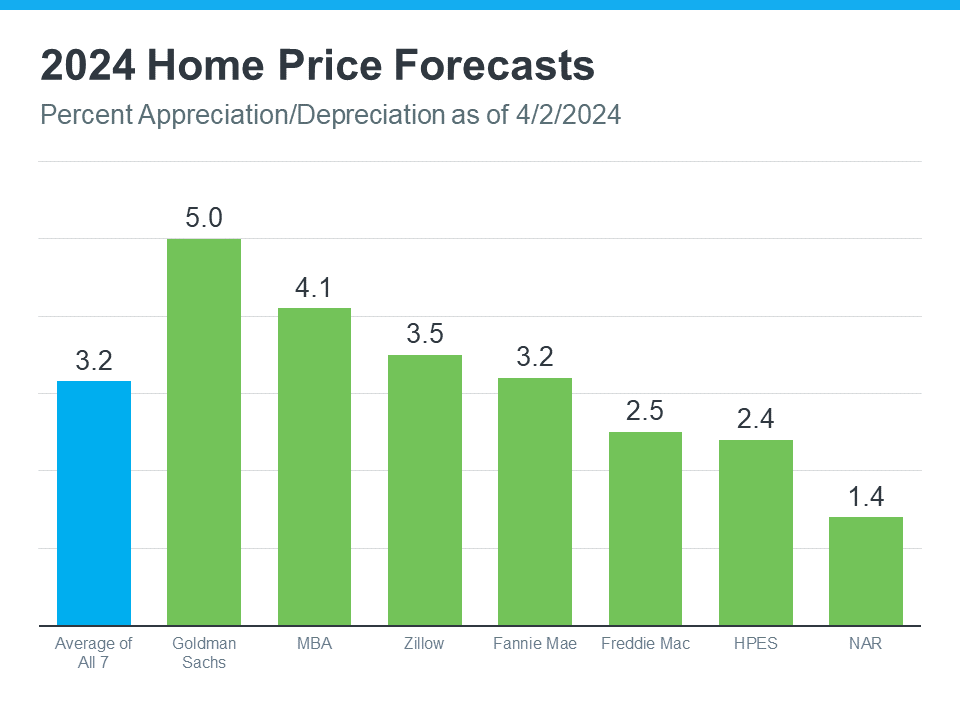

2. Home Prices

The second big factor to think about is home prices. Most experts project they’ll keep going up this year, but at a more normal pace. That’s because there are more homes on the market this year, but still not enough for everyone who wants to buy one. The graph below shows the latest 2024 home price forecasts from seven different organizations:

These forecasts are actually good news for you because it means the prices aren’t likely to shoot up sky high like they did during the pandemic. That doesn’t mean they’re going to fall – they’ll just rise at a slower pace.

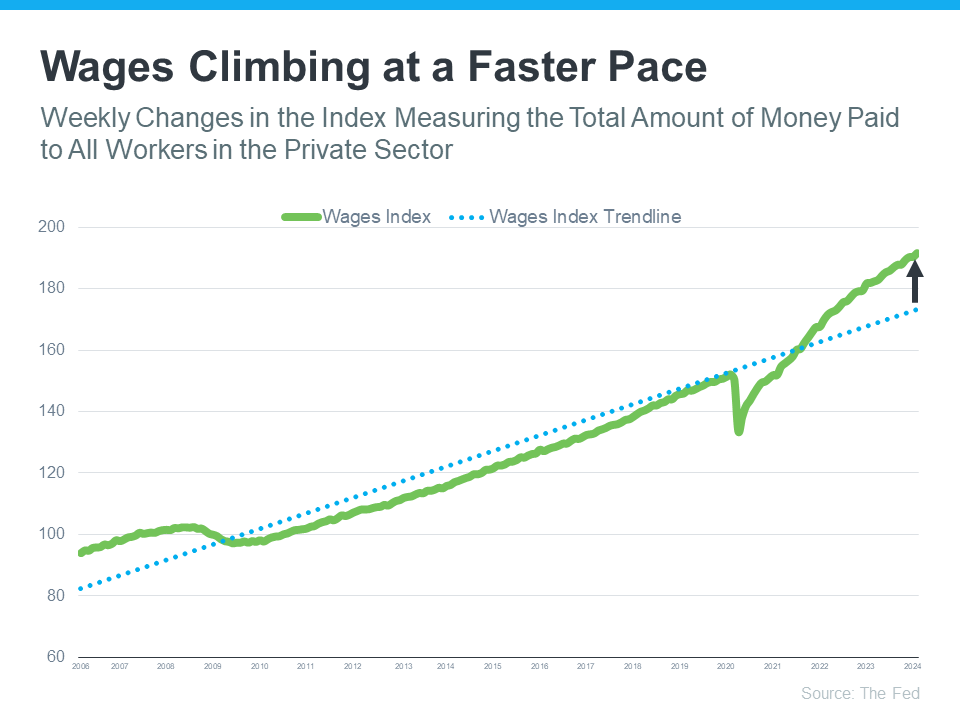

3. Wages

One factor helping affordability right now is the fact that wages are rising. The graph below uses data from the Federal Reserve to show how wages have been growing over time:

Check out the blue dotted line. That shows how wages typically rise. If you look at the right side of the graph, you’ll see wages are climbing even faster than normal right now.

Here’s how this helps you. If your income has increased, it’s easier to afford a home because you don’t have to spend as big of a percentage of your paycheck on your monthly mortgage payment.

Bottom Line

If you stack these factors up, you’ll see mortgage rates are still projected to come down a bit later this year, home prices are going up at a more moderate pace, and wages are growing quicker than normal. Those trends are a good sign for your ability to afford a home.

Ways To Use Your Tax Refund If You Want To Buy a Home

Have you been saving up to buy a home this year? If so, you know there are a number of expenses involved – from your down payment to closing costs. But did you also know your tax refund can help you pay for some of these expenses? As Credit Karma explains:

Have you been saving up to buy a home this year? If so, you know there are a number of expenses involved – from your down payment to closing costs. But did you also know your tax refund can help you pay for some of these expenses? As Credit Karma explains:

“If one of your goals is to stop renting and buy a home, you’ll need to save up for closing costs and a down payment on the mortgage. A tax refund can give you a start on the road to homeownership. If you’ve already started to save, your tax refund could move you down the road faster.”

While how much money you may get in a tax refund is going to vary, it can be encouraging to have a general idea of what’s possible. Here’s what CNET has to say about the average increase people are seeing this year:

“The average refund size is up by 6.1%, from $2,903 for 2023’s tax season through March 24, to $3,081 for this season through March 22.”

Sounds great, right? Remember, your number is going to be different. But if you do get a refund, here are a few examples of how you can use it when buying a home. According to Freddie Mac:

- Saving for a down payment – One of the biggest barriers to homeownership is setting aside enough money for a down payment. You could reach your savings goal even faster by using your tax refund to help.

- Paying for closing costs – Closing costs cover some of the payments you’ll make at closing. They’re generally between 2% and 5% of the total purchase price of the home. You could direct your tax refund toward these closing costs.

- Lowering your mortgage rate – Your lender might give you the option to buy down your mortgage rate. If affordability is tight for you at today’s rates and home prices, this option may be worth exploring. If you qualify for this option, you could pay upfront to have a lower rate on your mortgage.

The best way to get ready to buy a home is to work with a team of trusted real estate professionals who understand the process and what you’ll need to do to be ready to buy.

Bottom Line

Your tax refund can help you reach your savings goal for buying a home. Let’s talk about what you’re looking for, because your home may be more within reach than you think.

Don’t Let Your Student Loans Delay Your Homeownership Plans

If you have student loans and want to buy a home, you might have questions about how your debt affects your plans. Do you have to wait until you’ve paid off those loans before you can buy your first home? Or is it possible you could still qualify for a home loan even with that debt? Here’s a look at the latest information so you have the answers you need.

A Bankrate article explains:

“Roughly 60 percent of U.S. adults who have held student loan debt have put off making important financial decisions due to that debt . . . For Gen Z and millennial borrowers alone, that number rises to 70 percent.”

This includes one of the biggest financial decisions you’ll ever make, buying a home. But you should know, even with student loans, waiting to buy a home may not be necessary. While everyone’s situation is unique, your goal may be more within your reach than you realize. Here’s why.

Can You Qualify for a Home Loan if You Have Student Loans?

According to an annual report from the National Association of Realtors (NAR), 38% of first-time buyers had student loan debt and the typical amount was $30,000.

That means other people in a similar situation were able to qualify for and buy a home even though they also had student loans. And you may be able to do the same, especially if you have a steady source of income. As an article from Bankrate says:

“. . . you can have student loans and a mortgage at the same time. . . . If you have student loans and want a mortgage, there are multiple home loan programs you might qualify for . . .”

The key takeaway is, for many people, homeownership is achievable even with student loans.

You don’t have to figure this out on your own. The best way to make a decision about your goals and next steps is to talk to the professionals. A trusted lender can walk you through your options based on your situation, and share what’s worked for other buyers.

Bottom Line

Lots of other people with student loan debt are able to buy their own homes. Talk to a lender to go over your options and see how close you are to reaching your goal.

The Best Week To List Your House Is Almost Here

Are you thinking about making a move? If so, now may be the perfect time to start the process. That’s because experts say the best week to list your house is just around the corner.

A recent Realtor.com study looked at housing market trends over the past several years (with the exception of 2020, since it was an unusual year), and found the best week to put your house on the market this year is April 14-20:

“Every year, one week stands out from the rest as that perfect stretch of time when it’s great to be a home seller. This year, the week of April 14–20 is the best time to sell—that is, if sellers want to see lots of interest in their homes, sell quickly, and pocket some extra cash, according to Realtor.com® data.”

Here’s why this matters for you. While the spring market is a great time to sell no matter the week, this may be the peak sweet spot. And if you’ve been putting your plans on the back burner and waiting for the right time to act, this could be the nudge you need to make your move happen. As Hannah Jones, Senior Economic Research Analyst at Realtor.com explains:

“The third week of April brings the best combination of housing market factors for sellers. The best week offers higher buyer demand, lower competition [from other sellers], and fewer price reductions than the typical week of the year.”

But, if you want to get in on the action, you’ll need to move quickly and lean on the pros. Your local real estate agent is the perfect go-to when it comes to figuring out a plan to prep your house and get it on the market.

They’ll be able to offer advice to balance your target listing date with what you need to do from a repair and renovation standpoint. And they can walk you through exactly how to prioritize your list so you know what to tackle first.

For example, if your house is already in good shape, you’ll be able to really focus in on the smaller things that are easy to do and make a big impact. As an article from Investopedia says:

“You won’t have time for any major renovations, so focus on quick repairs to address things that could deter potential buyers.”

Here are some specific examples from that article:

Just remember, even if you’re not ready to list within the next couple of weeks, that’s okay. The window of opportunity doesn’t close when this week ends. Spring is the peak homebuying season and it’s still a seller’s market, so you’ll be in the driver’s seat all season long.

Bottom Line

Ready to get the ball rolling? Let’s connect and schedule a time to go over your next steps.

Does It Make Sense To Buy a Home Right Now?

Thinking about buying a home? If so, you’re probably wondering: should I buy now or wait? Nobody can make that decision for you, but here’s some information that can help you decide.

What’s Next for Home Prices?

Each quarter, Fannie Mae and Pulsenomics publish the results of the Home Price Expectations Survey (HPES). It asks more than 100 experts—economists, real estate professionals, and investment and market strategists—what they think will happen with home prices.

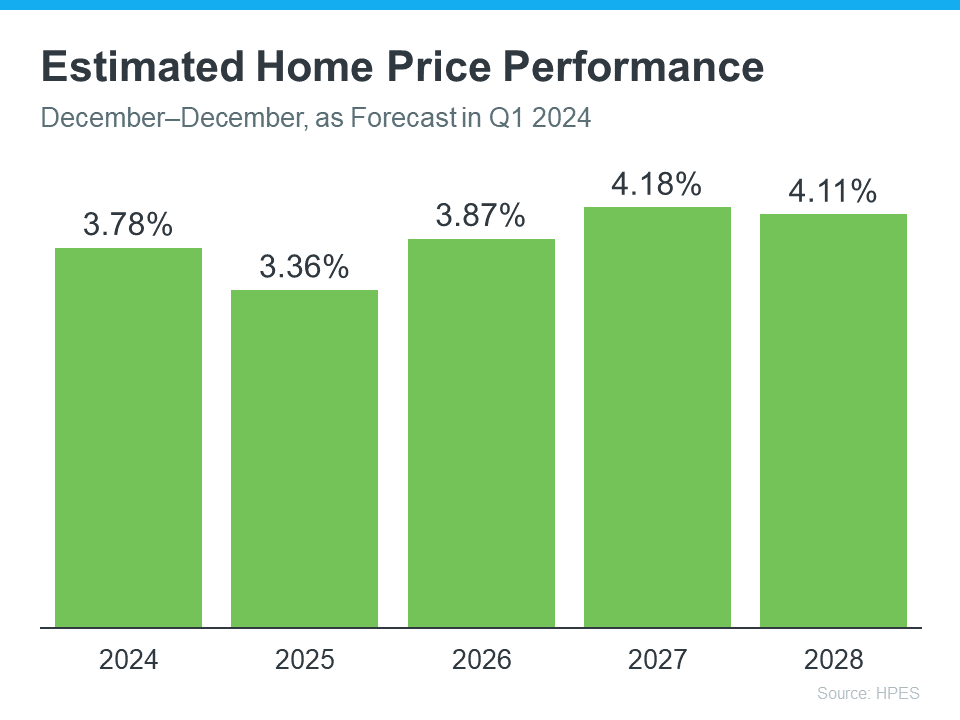

In the latest survey, those experts say home prices are going to keep going up for the next five years (see graph below):

Here’s what all the green on this chart should tell you. They’re not expecting any price declines. Instead, they’re saying we’ll see a 3-4% rise each year.

And even though home prices aren’t expected to climb by as much in 2025 as they are 2024, keep in mind these increases can really add up over time. It works like this. If these experts are right and your home’s value goes up by 3.78% this year, it’s set to grow another 3.36% next year. And another 3.87% the year after that.

What Does This Mean for You?

Knowing that prices are forecasted to keep going up should make you feel good about buying a home. That’s because it means your home is an asset that’s projected to grow in value in the years ahead.

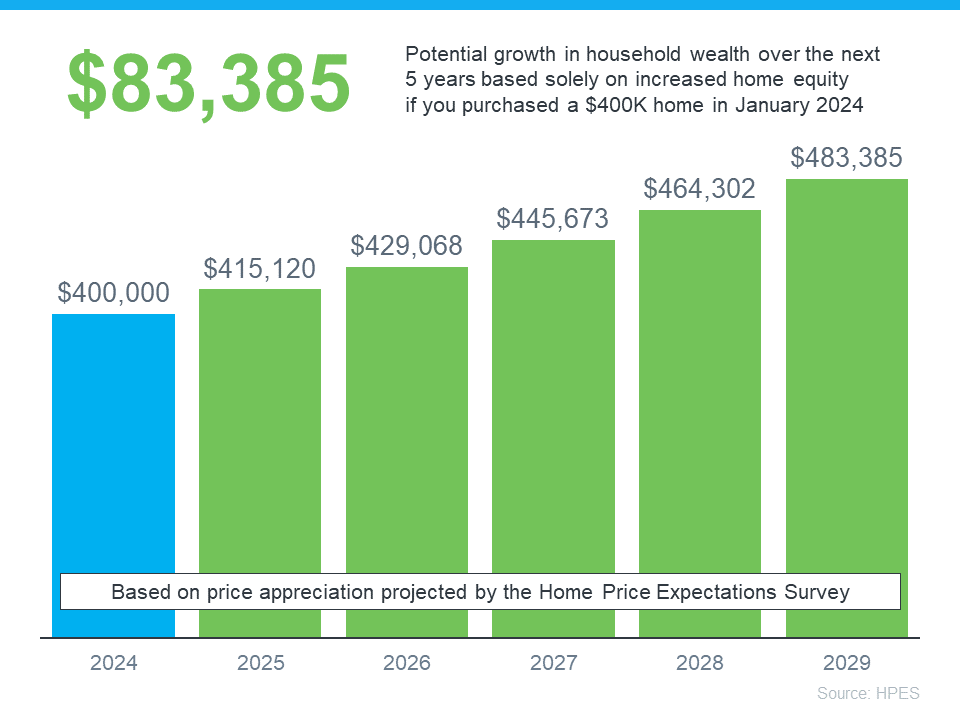

If you’re not convinced yet, maybe these numbers will get your attention. They show how a typical home’s value could change over the next few years using expert projections from the HPES. Check out the graph below:

In this example, imagine you bought a home for $400,000 at the start of this year. Based on these projections, you could end up gaining over $83,000 in household wealth over the next five years as your home grows in value.

Of course, you could also wait – but if you do, buying a home is just going to end up costing you more.

Bottom Line

4 Tips To Make Your Strongest Offer on a Home

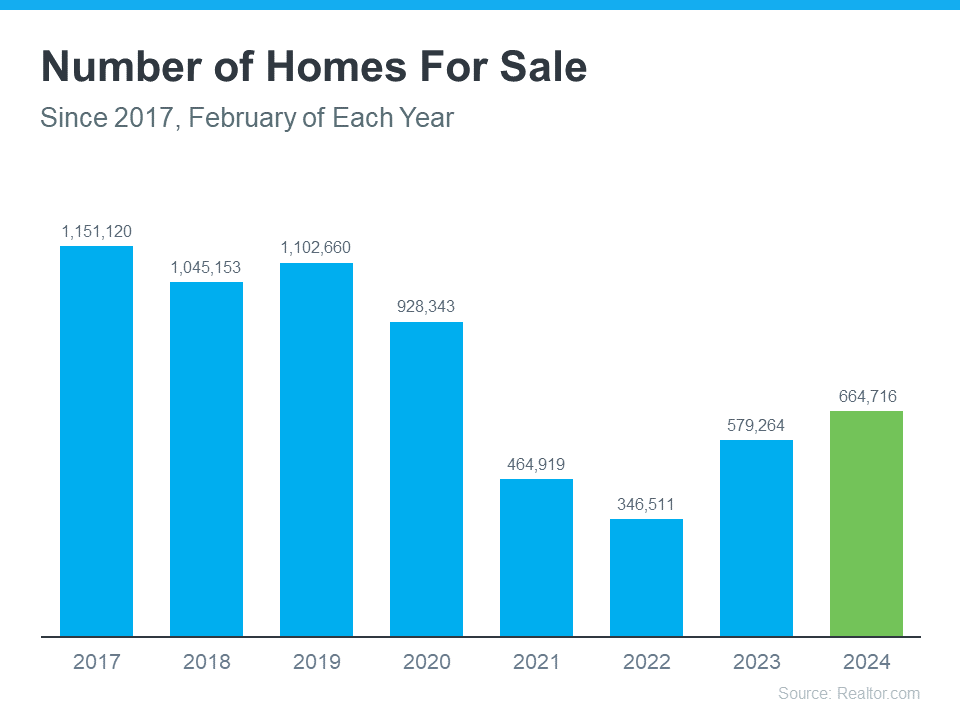

Are you thinking about buying a home soon? If so, you should know today’s market is competitive in many areas because the number of homes for sale is still low – and that’s leading to multiple-offer scenarios. And moving into the peak home buying season this spring, this is only expected to ramp up more.

Remember these four tips to make your best offer.

1. Partner with a Real Estate Agent

Rely on a real estate agent who can support your goals. As PODS notes:

“Making an offer on a home without an agent is certainly possible, but having a pro by your side gives you a massive advantage in figuring out what to offer on a house.”

Agents are local market experts. They know what’s worked for other buyers in your area and what sellers may be looking for. That advice can be game changing when you’re deciding what offer to bring to the table.

2. Understand Your Budget

Knowing your numbers is even more important right now. The best way to understand your budget is to work with a lender so you can get pre-approved for a home loan. Doing so helps you be more financially confident and shows sellers you’re serious. That gives you a competitive edge. As Investopedia says:

“. . . sellers have an advantage because of intense buyer demand and a limited number of homes for sale; they may be less likely to consider offers without pre-approval letters.”

3. Make a Strong, but Fair Offer

It’s only natural to want the best deal you can get on a home, especially when affordability is tight. However, submitting an offer that’s too low does have some risks. You don’t want to make an offer that’ll be tossed out as soon as it’s received just to see if it sticks. As Realtor.com explains:

“. . . an offer price that’s significantly lower than the listing price, is often rejected by sellers who feel insulted . . . Most listing agents try to get their sellers to at least enter negotiations with buyers, to counteroffer with a number a little closer to the list price. However, if a seller is offended by a buyer or isn’t taking the buyer seriously, there’s not much you, or the real estate agent, can do.”

The expertise your agent brings to this part of the process will help you stay competitive and find a price that’s fair to you and the seller.

4. Trust Your Agent During Negotiations

After you submit your offer, the seller may decide to counter it. When negotiating, it’s smart to understand what matters to the seller. Once you do, being as flexible as you can on things like moving dates or the condition of the house can make your offer more attractive.

Your real estate agent is your partner in navigating these details. Trust them to lead you through negotiations and help you figure out the best plan. As an article from the National Association of Realtors (NAR) explains:

“There are many factors up for discussion in any real estate transaction—from price to repairs to possession date. A real estate professional who’s representing you will look at the transaction from your perspective, helping you negotiate a purchase agreement that meets your needs . . .”

Bottom Line

In today’s competitive market, let’s work together to find you a home you love and craft a strong offer that stands out.

Finding Your Perfect Home in a Fixer Upper

If you’re trying to buy a home and are having a hard time finding one you can afford, it may be time to consider a fixer-upper. That’s a house that needs a little elbow grease or some updates, but has good bones. Fixer-uppers can be a really great option if you’re looking to break into the housing market or want to stretch your budget further. According to NerdWallet:

“Buying a fixer-upper can provide a path to homeownership for first-time home buyers or a way for repeat buyers to afford a larger home or a better neighborhood. With the relatively low inventory of homes for sale these days, a move-in ready home can be hard to find, especially if you’re on a budget.”

Basically, since the number of homes for sale is still so low, if you’re only willing to tour homes that have all your dream features, you may be cutting down your options too much and making it harder on yourself than necessary. It may be time to cast a wider net.

Sometimes the perfect home is the one you perfect after buying it.

Here’s some information that can help you pinpoint what you truly need so you can be strategic in your home search. First, make a list of all the features you want in a home. From there, work to break those features into categories like this:

- Must-Haves – If a house doesn’t have these features, it won’t work for you and your lifestyle.

- Nice-To-Haves – These are features you’d love to have but can live without. Nice-to-haves aren’t dealbreakers, but if you find a home that hits all the must-haves and some of these, it’s a contender.

- Dream State – This is where you can really think big. Again, these aren’t features you’ll need, but if you find a home in your budget that has all the must-haves, most of the nice-to-haves, and any of these, it’s a clear winner.

Once you’ve sorted your list in a way that works for you, share it with your real estate agent. They’ll help you find homes that deliver on your top needs right now and have the potential to be your dream home with a little bit of sweat equity. Lean on their expertise as you think through what’s possible, what features are easy to change or add, and how to make it happen. According to Progressive:

“Many real estate agents specialize in finding fixer-uppers and have a network of inspectors, contractors, electricians, and the like.”

Your agent can also offer advice on which upgrades and renovations will set you up to get the greatest return on your investment if you ever decide to sell down the line.

Bottom Line

If you haven’t found a home you love that’s in your budget, it may be worth thinking through all your options, including fixer-uppers. Sometimes the perfect home for you is the one you perfect after buying it. To see what’s available in our area, let’s connect.

What To Know About Credit Scores Before Buying a Home

If you want to buy a home, you should know your credit score is a critical piece of the puzzle when it comes to qualifying for a mortgage. Lenders review your credit to see if you typically make payments on time, pay back debts, and more. Your credit score can also help determine your mortgage rate. An article from US Bank explains:

“A credit score isn’t the only deciding factor on your mortgage application, but it’s a significant one. So, when you’re house shopping, it’s important to know where your credit stands and how to use it to get the best mortgage rate possible.”

That means your credit score may feel even more important to your homebuying plans right now since mortgage rates are a key factor in affordability. According to the Federal Reserve Bank of New York, the median credit score in the U.S. for those taking out a mortgage is 770. But that doesn’t mean your credit score has to be perfect. The same article from US Bank explains:

“Your credit score (commonly called a FICO Score) can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you don’t need that score or above to buy a home.”

Working with a trusted lender is the best way to get more information on how your credit score could factor into your home loan and the mortgage rate you’re able to get. As FICO says:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders and there are many additional factors that lenders may use to determine your actual interest rates.”

If you’re looking for ways to improve your score, Experian highlights some things you may want to focus on:

- Your Payment History: Late payments can have a negative impact by dropping your score. Focus on making payments on time and paying any existing late charges quickly.

- Your Debt Amount (relative to your credit limits): When it comes to your available credit amount, the less you’re using, the better. Focus on keeping this number as low as possible.

- Credit Applications: If you’re looking to buy something, don’t apply for additional credit. When you apply for new credit, it could result in a hard inquiry on your credit that drops your score.

Bottom Line

Finding ways to make your credit score better could help you get a lower mortgage rate. If you want to learn more, talk to a trusted lender.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link